The distance between the art student, the practicing artist, the gallerist and the collector/investor often seems so vast that it’s hard to believe they are all part of the same ecosystem. But of course they are, the product of a complex interlocking network of ideas, preferences, cultural values, economies and desires. Once was a time when artists stacked up their finished canvases in a corner of their studio. If they were lucky enough to be shown in a gallery, then the gallery got a cut, but often enough collectors or art-lovers visited the studio, had a glass or two of absinthe, paid some cash to the artist and walked out with the painting. Perhaps, as in Bazille’s amazing painting (above) a gentleman played piano while the negotiations were in progress.

OK, it’s an oversimplification. But the idea of a “quality” artist selling from their studio is now almost unthinkable. The link between artist and seller is so distant that many artists have no idea who currently “owns” their work. If they do meet up, over a glass of Cristal at a glamorous dinner party perhaps, it’s because the artist too has become a celebrity. Many successful artists never see their works again because they are consigned to storage as part of an investment strategy. Did you know that if you buy art as part of your superannuation you are not allowed to look at it? It must be locked away somewhere, otherwise you are getting a benefit from it before you are allowed to. You have to be sixty and retire first. Crazy! Strict rules govern investment in SMSH’s

A good artist has to have a gallery. Galleries compete for artists, but only if they sell, and especially if they have a rising reputation. Once with a gallery, the artist is no longer free to sell from their studio. They can give paintings away as gifts, of course, but even that is frowned upon. For decades this was the accepted system: an artist, a gallery, a buyer. In the secondary market, where art is on-sold from its first purchaser, auctions were the norm, but there were also private sales.

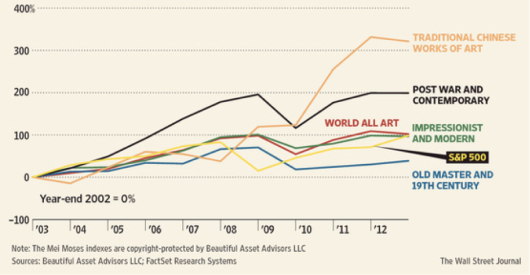

This was a fairly stable process until round about the 1990s. Then, in a strange contortion of late global capitalism, the rise of the super-elites, including traditional oligarchs, real-estate tycoons, movie stars and glamorous celebrities with infinite wealth saw the system change.

There were new players awash with funds from the “developing” economies: China, Brazil, India. And with the end of so-called communism funds were flooding around the globe and into the hands of gangsters and various versions of Mafia with their new-style goon squads: armies of suited accountants and investment managers. Gazillions of dollars went into superannuation funds which had to give a decent yield.

Periodic panics emerged, as they always do in a capitalist system. Stock markets rose and fell, raw materials markets collapsed, industrial work moved off-shore to low cost countries and then their bloated and unbalanced economies went off the rails. Democratic systems stalled. Military rule came back. Nothing was stable.

Where then could the super-rich, or their financial managers, deposit their gotten (ill or otherwise) gains?

Aha! The art market! What a great idea. Original works of art are just that: original. Walter Benjamin put his finger right on the pulse when he wrote about the aura of the art work in the age of mechanical reproduction. [It is worth reading and re-reading this work – so prescient, yet he had no idea in the 1930s how it would unfold].

The magic is that you cannot duplicate an original work of art. You can make prints of it, of course. Or someone can try forging it. But in the end there can one authentic example of each work, and only a limited number from each artist especially when the artist is dead.

Artists become superstars. A dizzying variety of choices emerge, some of them hard to “collect”, as in the best-known works of Tracey Emin. Tracey recently married a rock in a formal ceremony and they are reported to be very happy.

A dense supporting cast in the art world decide which works are important, which styles are great, which fashions are in. The art market itself slides in its preferences from time to time. How to invest in the right pieces? Let the market decide, it is capitalism after all.

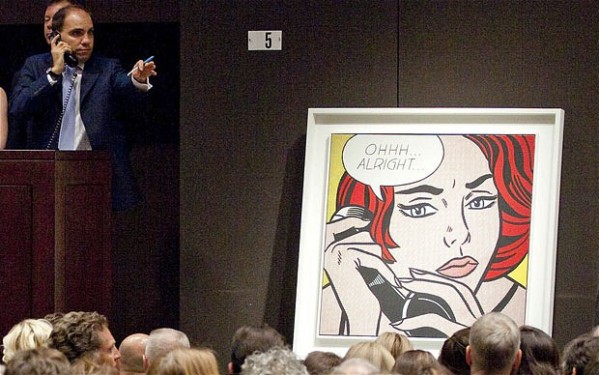

And so the glamour auction houses emerged in the main cities of global capitalism: London, New York, Hong Kong. Lesser markets emerged in outliers: Melbourne, Sydney, Vancouver, wherever there were funds to be invested and profits to be made. Some great books have been written about the world of the auction house. I mentioned some time ago the wonderful film of Isaac Julien, with its glimpses of the art market and interview with one of the main players in the British art market. Isaac Julien: PLAYTIME.

I will add shortly the titles of some books and articles I have really enjoyed, including some fiction.

So here we are today. The profound impulse to make and enjoy art has been ripped away from its base in local cultures and economies. The new Global Art Market is a dizzying beast. In the next few posts I will be looking at some recent trends and think about what it all means for the ordinary artist in backwaters like Australia.